The Ultimate Guide to Forex Currency Trading Online

Forex currency trading online has revolutionized the way we think about investment. With the rise of technology, traders can now engage in the fast-paced world of foreign exchange markets from the comfort of their own homes. Newcomers and experienced traders alike can benefit from this accessible market, which provides a wealth of opportunities for profit. Whether you are looking to supplement your income or aim for significant financial freedom, understanding forex trading is crucial. One excellent resource for boosting your trading skills is through the forex currency trading online Best Trading Apps available today.

What is Forex Trading?

Forex, or foreign exchange, refers to the global marketplace where currencies are traded. It is one of the largest financial markets globally, with a daily trading volume exceeding $6 trillion. Unlike traditional stock exchanges, the forex market operates 24 hours a day, five days a week, allowing traders to buy and sell currencies at any time. The market is decentralized, meaning there is no central exchange; instead, trading occurs over-the-counter (OTC) through electronic networks.

The Mechanics of Currency Pairs

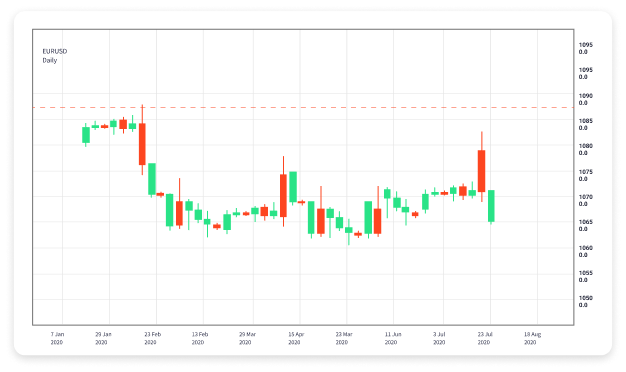

In forex trading, currencies are quoted in pairs, for example, EUR/USD, which signifies the exchange rate between the Euro and the U.S. Dollar. The first currency in the pair is known as the base currency, while the second one is called the quote currency. The price of the currency pair indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding the dynamics of these pairs is essential for forex trading.

Why Trade Forex?

There are several reasons why traders choose forex over other investment options. Firstly, the forex market is highly liquid, meaning there are plenty of buyers and sellers at any given time. This liquidity provides traders with tight spreads and the ability to enter and exit trades quickly. Furthermore, forex trading typically requires a smaller capital investment compared to stock trading, allowing more individuals to get involved.

Another significant advantage is the possibility of using leverage, which enables traders to control larger positions than their initial investment. While this can amplify profits, it’s important to understand that leverage can also lead to significant losses. As such, proper risk management strategies are crucial.

Choosing a Forex Broker

One of the first steps in your forex trading journey is selecting a broker. The right broker can significantly impact your trading success, so it’s essential to do thorough research. Look for brokers that are regulated by reputable financial authorities, as this ensures a level of security and trustworthiness.

Consider the trading platform they offer, the range of currency pairs available, and the fees charged for trades. Additionally, customer support, ease of deposit and withdrawal, and educational resources provided are vital factors to keep in mind when making your choice.

Developing a Trading Strategy

A well-defined trading strategy is vital for success in forex trading. This strategy should incorporate your goals, risk tolerance, and market analysis techniques. Many traders rely on fundamental analysis, which examines economic indicators, news releases, and geopolitical events that can impact currency values. On the other hand, technical analysis uses historical price charts and patterns to forecast future movements.

Some popular trading strategies include day trading, swing trading, and scalping. Day trading involves making multiple trades within a single day to capitalize on small price movements, while swing trading focuses on holding trades for several days or weeks to harness larger market movements. Scalping is a high-frequency trading strategy that aims for small profits on many trades. Each strategy has its pros and cons, so understanding which one suits your personality and circumstances is crucial.

Risk Management in Forex Trading

Effective risk management can make or break your trading success. It involves managing your exposure to risk so that you can survive long-term in the forex market. Key components of risk management include setting stop-loss orders to limit your potential losses, diversifying your trading portfolio across different currency pairs, and never risking more than a small percentage of your trading capital on a single trade.

Another important aspect is to continuously analyze and learn from your trades, both successful and unsuccessful. Keeping a trading journal can help you refine your strategies and improve your decision-making skills over time.

Continual Learning and Adaptation

The forex market is constantly changing due to economic dynamics, technology advancements, and global events. As a trader, staying updated with market trends and continuing your education is essential. Many online resources, such as webinars, trading courses, and blogs, are available to help traders enhance their skills and knowledge.

Joining online trading communities and forums can also provide valuable insights and support from other traders. Networking with experienced individuals can accelerate your learning curve and expose you to different trading perspectives.

Conclusion

Forex currency trading online offers incredible opportunities for financial success. However, it is vital to approach it with education, strategic planning, and risk management in mind. By understanding the fundamental concepts of forex trading, selecting a reliable broker, developing a sound trading strategy, and continually learning, you can navigate this exciting market effectively. Remember that patience and discipline are key elements of successful trading. Start your trading journey today, equipped with the right tools and knowledge to increase your profit potential.