Forex Trading for Beginners: A Comprehensive Overview

Forex trading, or foreign exchange trading, is one of the most popular forms of investment in the financial market. With a daily trading volume exceeding $6 trillion, the Forex market offers ample opportunities for traders. However, for beginners, it can be overwhelming. To help you get started, we’ve created this comprehensive guide that breaks down the complexities of Forex trading, equips you with essential knowledge, and points out the best practices to help you succeed. For more information on reliable trading options, check out forex trading for beginners Best Indonesian Brokers.

Understanding Forex Trading

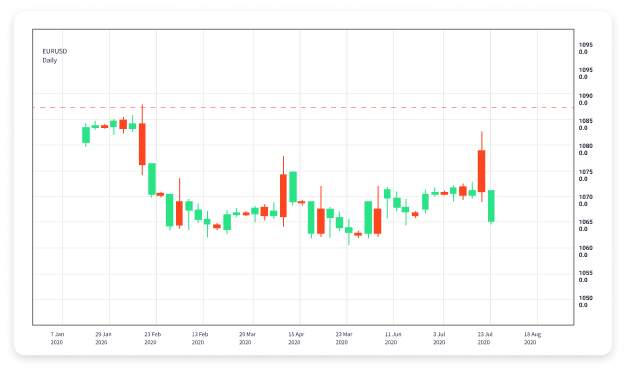

At its core, Forex trading involves the exchange of one currency for another at a determined price. For instance, if you buy the EUR/USD currency pair, you are purchasing euros with US dollars. The price of this pair reflects how many US dollars are needed to buy one euro. Traders speculate on currency price movements to make a profit.

Key Terms in Forex Trading

Before diving into trading, it’s vital to understand some basic terminology:

- Currency Pair: The quote of two different currencies, where one currency is quoted against the other (e.g., GBP/USD).

- Pips: The smallest price movement in the exchange rate of a currency.

- Leverage: A tool that allows traders to control a larger position than their actual investment.

- Spread: The difference between the buying and selling price of a currency pair.

Why Trade Forex?

The Forex market has several advantages that make it attractive for traders:

- High Liquidity: With millions of participants, buying and selling currencies can be done without significant price disruptions.

- 24/5 Trading: The Forex market operates 24 hours a day from Monday to Friday, allowing traders to enter and exit positions at any time convenient for them.

- Leverage: Forex brokers offer high leverage, allowing traders to increase their potential returns, but also their risks.

- Low Barriers to Entry: Beginners can start trading with small amounts of capital.

Getting Started with Forex Trading

The journey into Forex trading begins with some fundamental steps:

- Educate Yourself: Invest time in learning about Forex trading strategies, market trends, and analysis methods (both fundamental and technical).

- Choose a Reputable Broker: Look for brokers with a good reputation, favorable trading conditions, and excellent customer service.

- Open a Trading Account: Select an account type (demo or live) that suits your needs. A demo account is a great way to practice trading without risking real money.

- Develop a Trading Plan: Your plan should include your trading goals, risk tolerance, and strategies for entry and exit points.

- Start Trading: Begin with small amounts, and as you gain confidence and experience, you can adjust your investment size.

Types of Analysis in Forex Trading

Successful Forex trading requires analysis, and there are two primary methods:

- Fundamental Analysis: This approach involves evaluating economic, political, and social factors that can affect currency prices.

- Technical Analysis: Traders use historical price data and technical indicators to predict future price movements. Common tools include trend lines, moving averages, and relative strength index (RSI).

Risk Management in Forex Trading

One of the critical components of successful trading is managing risk. Here are some vital tips:

- Set Stop-Loss Orders: A stop-loss order minimizes your potential loss by automatically closing a trade when the price reaches a predetermined level.

- Use Proper Position Sizing: Ensure you’re not risking more than a small percentage of your trading capital on a single trade.

- Avoid Emotional Trading: Making decisions based on emotions can lead to significant losses. Stick to your trading plan.

Common Trading Strategies

Many Forex traders employ specific strategies to increase their chances of success:

- Scalping: This involves making multiple trades throughout the day to capture small price movements.

- Day Trading: Traders open and close positions within a single trading day to avoid overnight risks.

- Swing Trading: This strategy involves holding positions for several days or weeks to capitalize on expected market changes.

- Position Trading: Long-term strategy where traders hold positions for months or years, relying on fundamental analysis.

Choosing the Right Broker

The importance of selecting a reliable broker cannot be overstated. Look for features like low spreads, high leverage, and a user-friendly trading platform. Always check for reviews, regulatory compliance, and customer support quality before making your choice.

Conclusion

Forex trading can be a rewarding endeavor if approached correctly. As a beginner, take the time to educate yourself, develop a tailored trading plan, and practice sound risk management. By doing so, you’ll be better positioned to navigate the complexities of the Forex market and work towards achieving your trading goals. Remember, consistent practice, discipline, and continuous learning are key to long-term success in Forex trading.